4 Easy Facts About Life Insurance Explained

Table of ContentsWhole Life Insurance for DummiesSome Ideas on American Income Life You Need To KnowWhat Does Term Life Insurance Louisville Do?The Best Strategy To Use For Term Life Insurance Louisville9 Simple Techniques For Life Insurance Louisville Ky

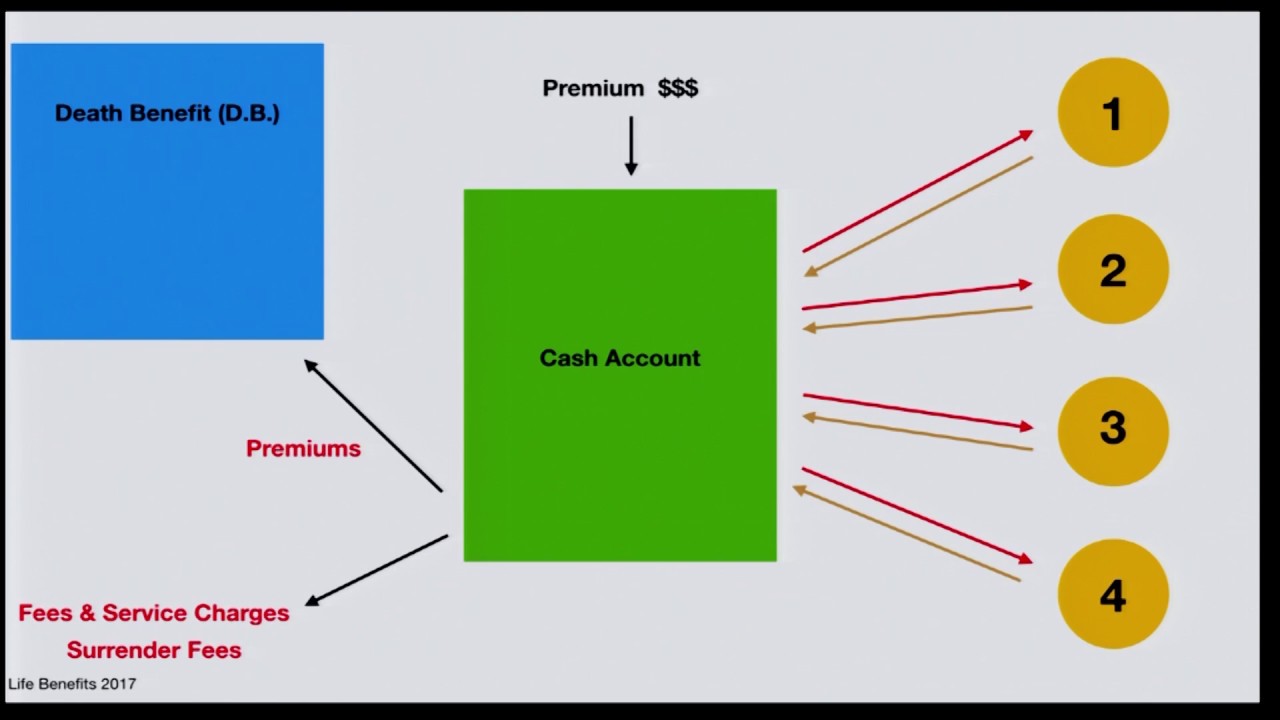

Life insurance policy gives monetary defense for individuals you respect. You pay a month-to-month or annual costs to an insurance policy business, as well as in exchange the company pays a tax-free swelling sum of cash to your recipient if you die while the policy is energetic. You can personalize your life insurance policy policy to fit your family's demands by selecting the sort of policy you acquire, the variety of years you desire it to last, and the amount of money paid - Senior whole life insurance.Life insurance policy is a really typical asset that figures into lots of people's lasting financial preparation - Life insurance company. Purchasing a life insurance policy is a method to safeguard your loved ones, supplying them with the financial backing they may need after you pass away. As an example, you might purchase life insurance policy to aid your partner cover mortgage repayments or everyday expenses or fund your children's college education and learning.

This can assist with selecting a payout option that functions finest for your estate planning objectives. Secret Takeaways Life insurance policy is an agreement in between an insurance holder as well as an insurance provider that's designed to pay out a death advantage when the guaranteed individual dies (Senior whole life insurance). A life insurance coverage business ought to be spoken to as soon as feasible adhering to the death of the insured to begin the cases and also payment procedure.

How Kentucky Farm Bureau can Save You Time, Stress, and Money.

There are different ways a recipient may receive a life insurance payment, including lump-sum repayments, installment repayments, annuities, as well as preserved asset accounts. Life Insurance Fundamentals Life insurance coverage is a type of insurance policy agreement.

Some life insurance policy plans can supply both fatality benefits and living benefits. A living advantage cyclist allows you to take advantage of your policy's survivor benefit while you're still active. This sort of cyclist can be useful in circumstances where you're terminally sick and also need funds to pay for clinical treatment.

These policies make it possible for the insurance policy holder to be the recipient of their own life insurance coverage policy," claims Ted Bernstein, owner of Life process Financial Planners LLC. When purchasing life insurance policy, it is essential to consider: How much insurance coverage you require Whether a term life or irreversible life plan makes a lot more sense What you'll spend for premiums Which cyclists, if any type of, you want to consist of The distinctions in between life insurance policy estimates for every possible plan In regards to insurance coverage amounts, a life insurance coverage calculator can be useful in picking a survivor benefit.

Some Known Factual Statements About American Income Life

Life insurance coverage premium costs can depend on the kind of policy, the quantity of the fatality benefit, the motorcyclists you include, as well as your overall health and wellness.

Minor youngsters can not be called as beneficiaries of a life insurance policy plan. Submitting a Case Survivor benefit are not paid immediately from a life insurance policy. The recipient has to initially submit a insurance claim with the life insurance policy company. Depending on the insurance firm's plans, this may be done online or it may require a paper claims declaring.

Some Known Questions About Child Whole Life Insurance.

There's no set due date for exactly how long you have to submit a life insurance policy claim yet the faster you do so, the much better. When Advantages Are Paid Life insurance coverage benefits are usually paid when the insured celebration passes away. Recipients submit a death claim with the insurer by sending a qualified copy of the death certification.

If a business denies your claim, it normally provides a reason why. A lot of insurance coverage companies pay within 30 to 60 days of the date of the claim, according to Chris Huntley, creator of Huntley Riches & Whole life insurance Insurance Policy Services.

Rumored Buzz on American Income Life

The factor: the one- to two-year contestability condition. "Many plans include this stipulation, which permits the carrier to examine the original application to make certain fraudulence was not committed. As long as the insurance provider can not show the insured pushed the application, the benefit will typically be paid," says Huntley.

If you or someone you recognize is experiencing anxiety or psychological wellness problems, get help now. You are not the only one. If you or a liked one is pondering self-destruction, contact the National Suicide Avoidance Lifeline at 1-800-273-8255 or by means of real-time chat. It's readily available 24 hrs a day, seven days a week, and provides complimentary and confidential support.